Efficient financial management is crucial for business and personal success. As technology continues to evolve, artificial intelligence has emerged in the accounting industry, offering innovative solutions to streamline processes, reduce errors, and provide valuable insights.

This article explores the top AI accounting tools that are changing how businesses handle their finances. From automating routine tasks to providing real-time analytics, these cutting-edge platforms are designed to enhance accuracy, save time, and empower financial decision-making. Whether you’re a small business owner, a freelancer, or an accounting professional, these AI-powered tools offer a range of features to meet diverse needs and transform financial management practices.

Vic.ai is an advanced AI-powered accounting tool that revolutionizes accounts payable processes. By leveraging sophisticated machine learning algorithms, Vic.ai automates and streamlines various finance tasks, with a particular focus on accounts payable. The platform’s intelligent system can automatically ingest, classify, and process invoices with exceptional accuracy, significantly reducing the need for manual data entry and virtually eliminating human errors in the process.

One of Vic.ai’s standout features is its ability to mimic human decision-making, enabling it to manage the entire accounts payable workflow from start to finish autonomously. This capability allows finance teams to shift their focus from routine tasks to more strategic activities such as financial analysis, cash flow forecasting, and vendor relationship management. Vic.ai’s continuous learning mechanism ensures that the AI adapts to each organization’s unique processes and requirements over time, leading to increasingly efficient and accurate operations.

Key features:

- Autonomous invoice processing that boosts productivity by up to 355%

- AI-driven PO matching that detects discrepancies and ensures precise matching

- Streamlined approval workflows that reduce manual effort and accelerate invoice approvals

- Intelligent payment processing that identifies early payment discounts and minimizes fraud risks

- Real-time analytics and insights on invoices, team performance, and business trends to support data-driven decision making

Bill is a comprehensive cloud-based accounting software designed to optimize accounts payable and accounts receivable processes for businesses of all sizes. The platform harnesses the power of AI and machine learning to simplify invoice management, streamline approval workflows, and automate payment processing. By doing so, Bill significantly reduces the time spent on financial tasks while minimizing errors that often occur in manual processes.

One of Bill’s primary strengths lies in its seamless integration capabilities with popular accounting systems, ensuring real-time data synchronization and providing enhanced visibility into financial operations. The platform’s user-friendly interface, coupled with its customizable options, makes it an attractive choice for businesses looking to modernize their financial processes. Bill empowers organizations to gain better control over their cash flow, strengthen vendor relationships, and allocate more resources to strategic initiatives rather than routine financial tasks.

Key features:

- Streamlined invoice management that automates invoice capture, data entry, and categorization

- Customizable approval workflows that allow setup of multi-level approval processes

- Flexible payment options supporting various methods including ACH, EFT, virtual cards, and checks

- International payment processing enabling transactions in over 130 countries

- Seamless integration with popular accounting software like QuickBooks, Xero, and NetSuite

TurboDoc is an innovative AI-powered accounting tool that specializes in automating invoice and receipt processing. The platform leverages cutting-edge optical character recognition (OCR) technology to accurately extract data from documents in various formats. This advanced capability eliminates the need for manual data entry, significantly reducing the time and effort required for processing financial documents while simultaneously minimizing the risk of human error.

Beyond its core OCR functionality, TurboDoc offers a user-friendly interface that organizes extracted information in an intuitive manner. This feature enables businesses to effortlessly analyze data, assemble reports, and compare financial information across different periods or categories. TurboDoc’s emphasis on data security is evident in its use of enterprise-level encryption to protect sensitive financial information. Furthermore, the platform’s seamless integration with popular email services like Gmail allows users to automate document processing directly from their inboxes, streamlining workflow and enhancing overall productivity.

Key features:

- Advanced OCR technology that processes documents in an average of 1.2 seconds per page

- High-accuracy data extraction with a 96% accuracy rate

- Seamless Gmail integration for automated document processing from inboxes

- User-friendly dashboard for easy data analysis and report assembly

- AES256 enterprise-level encryption for secure data storage on USA-based servers

Indy is a comprehensive productivity platform meticulously designed to cater to the unique needs of freelancers and independent professionals. While not exclusively an accounting tool, Indy offers a robust suite of financial management features alongside other essential business functions. This all-in-one approach allows freelancers to manage various aspects of their business, including proposals, contracts, invoicing, time tracking, task management, and client communication, all from a single, user-friendly interface.

One of Indy’s most compelling attributes is its affordability, making it an accessible option for freelancers at various stages of their career. The platform offers a free plan with essential features, as well as competitively priced paid plans that provide access to more advanced tools. Indy’s intuitive design and ease of use make it an attractive choice for freelancers who want to efficiently manage their business finances without the need for extensive training or a steep learning curve. By consolidating multiple business functions into one platform, Indy helps freelancers save valuable time and stay organized, allowing them to focus more on their core business activities and client relationships.

Key features:

- Customizable proposal and contract templates with legal vetting

- Integrated invoicing and payment processing through popular gateways

- Time tracking tool for recording billable hours

- Project management features for task organization

- Built-in client communication and file sharing capabilities

Docyt is a state-of-the-art AI-powered accounting automation platform designed to improve financial management for small businesses and accounting professionals. By harnessing the power of advanced generative AI capabilities, Docyt automates a wide range of accounting processes, including data capture, workflow management, and real-time reconciliation. This comprehensive approach provides businesses with unprecedented visibility and precision in their financial operations, enabling more informed decision-making based on up-to-date and accurate financial insights.

At the core of Docyt’s functionality are its intelligent algorithms, which possess the ability to read and understand expenses with human-like comprehension. This advanced technology accurately extracts information from receipts and invoices, categorizing transactions with a high degree of confidence. Docyt’s cutting-edge platform enables true real-time accounting, a feature that sets it apart from many traditional accounting solutions. Furthermore, Docyt seamlessly integrates with existing accounting systems, ensuring a smooth transition and minimal disruption to established processes. The platform’s user-friendly interface, combined with its powerful automation features, positions Docyt as a game-changer in the way businesses manage their accounting functions.

Key features:

- AI-driven data capture from receipts, invoices, and other financial documents

- Automated accounting workflows for tasks like invoice processing and approval routing

- Real-time financial data reconciliation for up-to-date information access

- Comprehensive financial insights and reporting capabilities

- Seamless integration with existing accounting systems and business tools

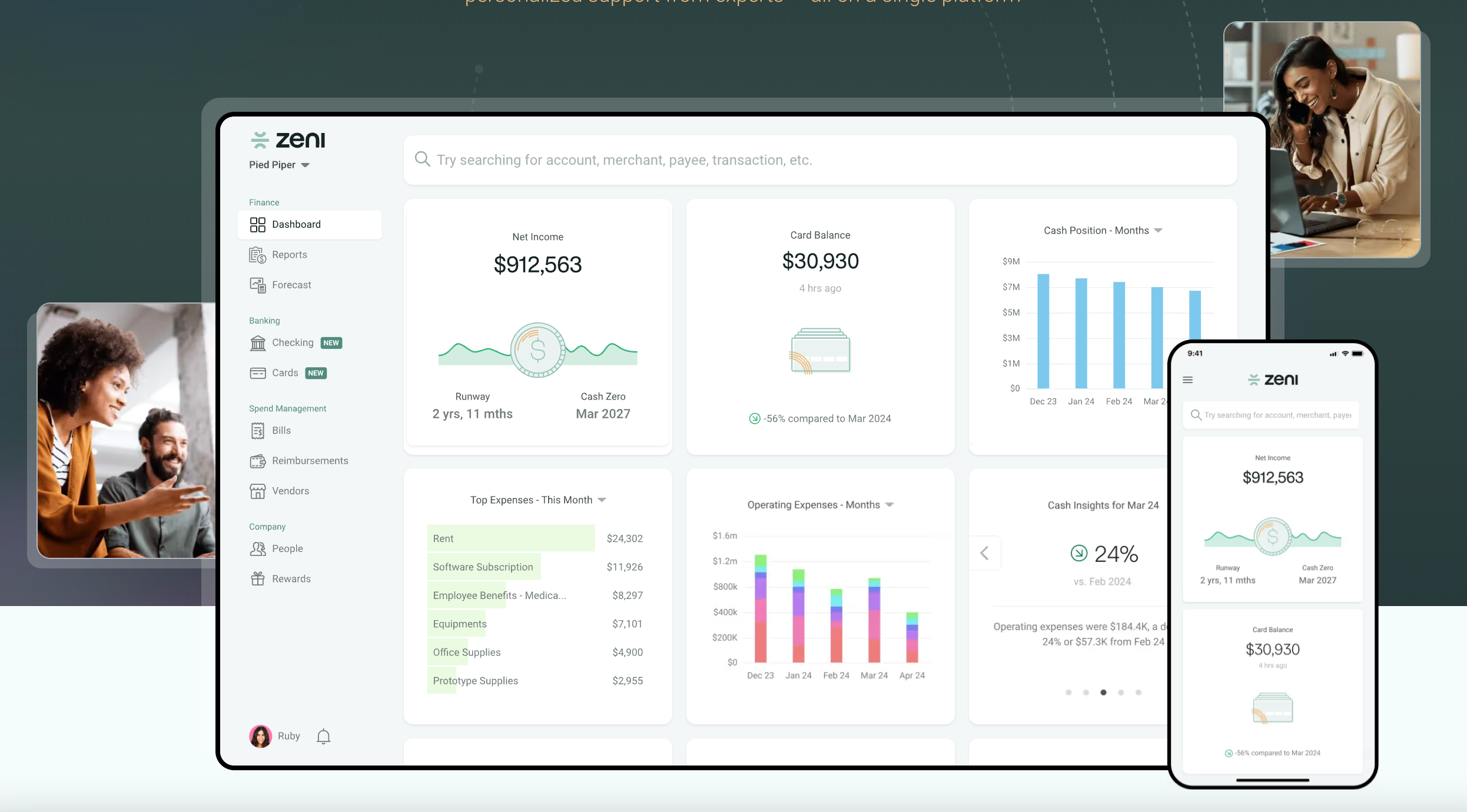

Zeni is an innovative AI-powered finance platform that combines intelligent bookkeeping, accounting, and CFO services to streamline financial operations for startups and small businesses. By leveraging advanced AI technology, Zeni automates a wide array of manual processes, providing real-time insights and offering personalized support from a dedicated team of finance experts. This comprehensive approach enables businesses to update their books daily, access real-time financial data, and make informed decisions based on accurate, up-to-date information.

One of Zeni’s key strengths lies in its ability to provide a complete financial solution on a single platform. From bill pay and invoicing to expense management and financial planning, Zeni offers a wide range of services to meet the diverse needs of growing businesses. The platform’s user-friendly interface, coupled with expert support from a dedicated finance team, makes it an attractive choice for entrepreneurs and business owners looking to optimize their financial operations and focus on growth. By consolidating multiple essential tools into one package, Zeni helps businesses save money and simplify their technology stack, providing a cost-effective solution for comprehensive financial management.

Key features:

- AI-powered bookkeeping that automatically categorizes transactions and reconciles accounts

- Comprehensive financial services including bill pay, invoicing, and expense management

- Real-time financial insights and customizable reporting capabilities

- Access to a dedicated team of finance experts, including bookkeepers, accountants, and CPAs

- Seamless integration with popular business tools and platforms

Blue dot is an AI-driven tax compliance platform designed to address the complexities of modern employee spend management. With the rise of hybrid work environments, decentralized purchasing, and online consumption, employee-triggered transactions have become increasingly prevalent, posing challenges for finance teams dealing with unstructured financial data. Blue dot’s platform tackles these issues by providing comprehensive coverage in both VAT and taxable employee benefit spaces.

The platform’s technology leverages advanced AI algorithms and machine learning to digitize tax compliance, automating various financial processes while reducing manual effort and ensuring accuracy. Blue dot offers optimized VAT outcomes by identifying eligible and qualified VAT spend in compliance with country tax regulations and company policies, ensuring accurate domestic VAT posting and foreign VAT refunds. Additionally, the platform automates the review of consumer-style spend subject to taxable employee benefits, ensuring compliance with wage taxation and pay-as-you-earn reporting requirements. By combining these features with an automatically updated tax knowledge base and configurable rule engines, Blue dot provides a robust solution for modern tax compliance challenges.

Key features:

- Smart automation of financial processes for enhanced accuracy and audit preparedness

- Optimized VAT outcomes through AI-driven identification of eligible spend

- Automated review of taxable employee benefits for wage taxation compliance

- Continuously updated tax knowledge base with configurable rule engines

- Advanced AI and ML capabilities leveraging deep learning and natural language processing

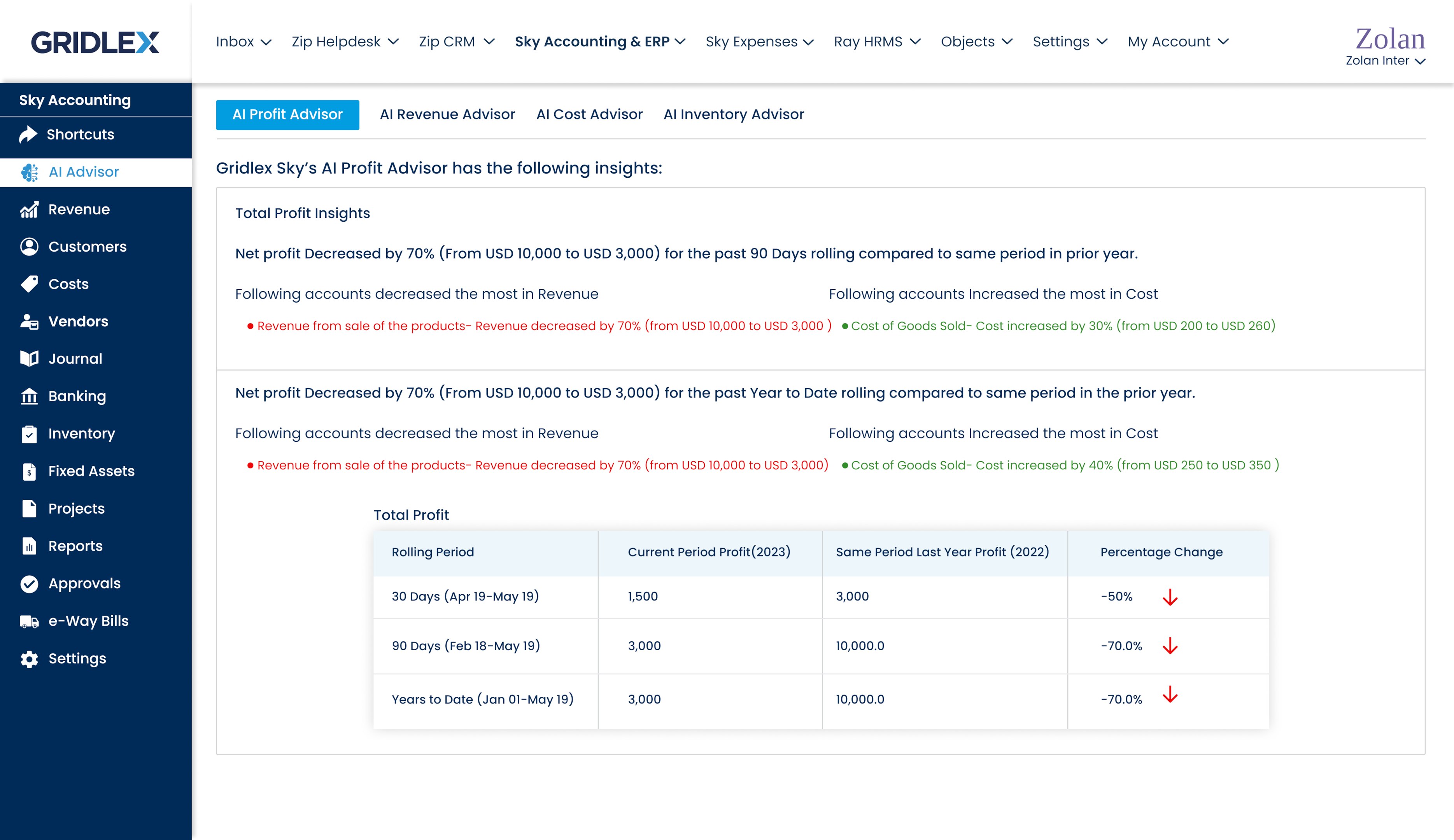

Gridlex is a versatile, all-in-one app builder designed to streamline operations and boost productivity across various industries. While not exclusively an accounting tool, Gridlex offers a comprehensive suite of features that includes CRM, customer service, help desk ticketing, master data management, and operations management. The platform’s ultra-customizable nature allows organizations to configure the app builder to meet their specific needs, ensuring a tailored solution that addresses unique business challenges.

One of Gridlex’s standout features is its accounting and ERP module, Gridlex Sky. This component enables businesses to manage their finances effectively, offering capabilities such as invoicing, bill management, and bank reconciliation. By automating financial processes, reducing manual calculations, and simplifying expense claims, Gridlex Sky significantly enhances accounting efficiency. The platform’s AI-driven insights help businesses analyze their financial data, facilitating informed decision-making and strategic planning. Additionally, Gridlex’s ability to consolidate multiple essential tools into a single, cost-effective package helps businesses save money and simplify their technology stack, making it an attractive option for organizations looking to streamline their operations.

Key features:

- Comprehensive accounting and ERP functionality through Gridlex Sky module

- AI-powered financial insights for data analysis and strategic planning

- Multi-currency transaction handling for global business operations

- Integrated inventory management for efficient tracking and optimization

- Built-in timesheet and HR software for streamlined workforce management

Truewind is an AI-powered accounting and finance platform specifically designed to streamline bookkeeping and financial management for startups and small to medium-sized businesses (SMBs). By harnessing the power of generative AI technologies, Truewind automates routine accounting tasks, delivers accurate and timely financial reports, and offers strategic insights to support business growth. The platform’s approach combines AI-driven processes with expert human oversight, resulting in a comprehensive, efficient, and reliable financial management solution.

At the core of Truewind’s offerings are AI-powered bookkeeping, month-end close automation, and CFO services. The platform seamlessly integrates with popular accounting software such as QuickBooks, NetSuite, and Xero, ensuring a smooth transition and minimal disruption to existing processes. Truewind’s commitment to data security and privacy is evident in its adherence to the highest standards, including SOC 2 certification and strict data privacy policies. This combination of cutting-edge AI technology, human expertise, and robust security measures positions Truewind as a powerful tool for businesses seeking to optimize their financial operations and drive growth.

Key features:

- AI-powered bookkeeping for faster and more accurate financial record-keeping

- Automated month-end close process to accelerate financial reporting

- CFO services providing strategic insights and forecasting for business growth

- Seamless integration with popular accounting software platforms

- SOC 2 certified data security and strict privacy policies

Booke is an innovative AI-powered bookkeeping automation platform designed to streamline financial processes for businesses and accounting professionals. By leveraging advanced AI technologies such as Robotic Process Automation (RPA) and Generative AI, Booke automates time-consuming tasks like transaction reconciliation and categorization, significantly reducing manual workload and enhancing accuracy. The platform’s intelligent algorithms excel at extracting data from financial documents in real-time, ensuring that financial records are always up-to-date and precise.

One of Booke’s key strengths lies in its seamless integration capabilities with popular accounting software such as Xero, QuickBooks, and Zoho Books. This integration ensures a smooth workflow and minimizes disruption to existing processes, making it an ideal solution for businesses looking to enhance their financial operations without overhauling their entire system. Booke’s user-friendly interface, combined with its powerful automation features, significantly improves efficiency and accuracy in financial management. By automating daily and month-end bookkeeping processes, including categorizing and matching bank feed transactions with corresponding bills, invoices, and receipts, Booke allows finance professionals to focus on more strategic tasks, ultimately leading to improved client satisfaction and business growth.

Key features:

- AI-driven automation of transaction reconciliation and categorization

- Real-time data extraction from financial documents for up-to-date records

- Seamless integration with popular accounting software platforms

- Automated daily and month-end bookkeeping processes

- Enhanced efficiency and accuracy in financial management tasks

Why Use an AI Accounting Tool?

The rapid evolution of AI accounting tools has transformed the landscape of financial management, offering unprecedented advantages to businesses of all sizes. These innovative solutions streamline accounting processes, reducing the time and effort required for routine tasks such as data entry and transaction categorization. By automating these mundane activities, AI tools free up accounting professionals to focus on more strategic aspects of financial reporting and analysis, ultimately adding more value to their organizations or clients.

One of the most significant benefits of AI accounting tools is their ability to provide real-time financial insights. Unlike traditional methods that often rely on periodic reporting, these advanced platforms offer up-to-the-minute data on a company’s financial health. This immediate access to accurate financial data empowers decision-makers to respond swiftly to market changes, identify potential issues before they escalate, and capitalize on emerging opportunities. Moreover, the enhanced accuracy of AI-driven financial reports minimizes the risk of errors that can lead to costly mistakes or compliance issues.

As the accounting industry continues to embrace technological advancements, AI tools are becoming indispensable for maintaining a competitive edge. These platforms not only improve efficiency and accuracy but also enhance the overall quality of financial services provided by accounting firms. By leveraging AI in their daily operations, accountants can offer more comprehensive and insightful financial analysis, strengthening their role as trusted advisors to their clients. Ultimately, the adoption of AI accounting tools represents a strategic investment in the future of financial management, promising to deliver long-term benefits in terms of productivity, accuracy, and decision-making capabilities.

Leave a comment