Have you ever wondered if AI crypto trading bots actually work—or if they’re just smoke and mirrors?

I spent weeks testing eleven platforms—some strategy engines, others alert bridges—all hooked to Coinbase Pro or Binance via API. I wanted to see how they perform in real trading conditions. What stood out, what flopped, and which bot might fit exactly what you’re looking for? Let’s dig in.

Why Use an AI Crypto Trading Bot?

These bots can work around the clock, zap emotion out of your trading, backtest strategies, and even execute trades based on complex rules. But the catch is picking one that fits your trading style—whether you’re a hands-off investor or a strategy builder.

How I Tested Them

- Connected each tool via API/webhook to a test exchange account

- Ran live strategies or alerts with small capital

- Focused on usability, strategy flexibility, backtest tools, and support

- Compared what each bot has versus what it promises to deliver

⬇️ See the top AI Crypto bots

What Really Matters in a Good AI Bot

- Strategy Types: Grid, DCA, trend following, pattern recognition

- Execution: Native trading API vs alert/webhook pathways

- Ease of Use: setup complexity, interface flow

- Transparency: backtests, risk data, drawdowns

- Cost & Value: free trial, pricing tiers, access to features

Best Crypto Trading Bot: Here is What I Found

- Aterna AI

- Tickeron

- Intellectia

- Coinrule

- TradeIdeas

- TradingView

- TradeSanta

- Kavout

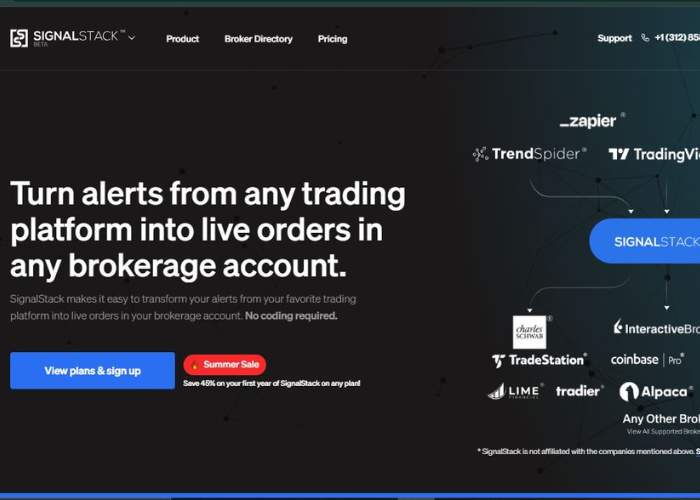

- Signal Stack

- Bitsgap

Core Features

- Hands-off execution

- AI-driven pattern detection

- Dynamic risk sizing

- Claims ~4.3% monthly return with <4% max drawdown based on verified 2024 results.

Best For

Busy professionals who want passive automation without constant monitoring.

My Take

Setup was seamless, trades executed without fuss. Results felt realistic—but public transparency is light. Promising, but trust builds over time.

Core Features

- Single‑ticker ML agents

- Candlestick pattern detection

- Backtests

- Prebuilt Day Trader” or “Momentum” bots

Best For

Traders who want focused AI signals on one asset like BTC or SOL.

My Take

Plug-and-play easy. You can start a NVDA agent and let it run. Limitations present if you want multi-coin strategies or custom configuration.

Core Features

- Swing-trade signals based on sentiment, fundamentals, XGBoost/ML

- InvestGPT chat interface

- Multi-coin analysis

Best For:

Data-driven traders who prefer insight-led decision making rather than full automation.

My Take

Signals are nuanced and helpful. API execution is absent—alerts lead to manual or webhook-injected trades. Still, it guided my timing and sizing well.

Core Features

- Rule-based IF–THEN builder

- Strategy marketplace

- Backtesting

- Exchange integration including Coinbase and Binance

Best For

Traders who want no-code automation across multiple exchanges with templates and flexibility.

My Take

Building a strategy (e.g. RSI‑cross DCA) on the fly felt intuitive. Connecting and executing real trades was clean and fast.

Core Features

- Holly AI engine

- OddsMaker backtesting

- TradeWave momentum module, alert-driven trade signals

Best For

Aadvanced swing/day traders seeking deep signal scanning plus standalone execution via webhook integrations.

My Take

Market scans are intense, signals sharp—but there’s a steep learning curve. It delivers power once you master it.

Core Features

- Custom Pine Script strategy builder

- Alerts

- Charting

- Community script marketplace

- Execution via connectors (e.g. WunderTrading)

Best For

DIY traders building bespoke strategies who want full flexibility with alert-triggered execution.

My Take

Very powerful if you’re comfortable scripting. Strategy tuning takes effort. Works amazingly well when paired with execution bridge tools.

Core Features

- Cloud bots supporting DCA, GRID, futures

- Binance and exchange auto-connect, templates, trailing take-profit

Best For

Users craving simple, reliable bot automation with template strategies.

My Take

Setup was nearly foolproof. Templates run well and have stability—great option if coding isn’t your thing.

Core Features

- Kai Score

- Smart Signals across crypto & stocks

- Natural language InvestGPT chat

- Portfolio diagnostics

Best For

Traders prioritizing signal insights over automation.

My Take

Signals are polished and disciplined. No trade execution from the platform—but signal quality strong for decision-making.

Core Features

Converts alerts from TradingView, TrendSpider, etc., into automated trades executed in ~0.5s across exchanges and brokers

Best For

Traders who build alerts and want zero-latency execution.

My Take

Lean and dependable. Feels like automation glue—perfect if you’re busy coding alerts and just need execution sorted.

Core Features

- Multi-exchange support

- Grid, DCA, combo bots, portfolio tracking and backtest tools—but crypto only, no stocks

Best For

Serious crypto multi-coin portfolio managers.

My Take

Excellent for crypto traders using multiple exchanges. But not applicable for stock users.

Comparison Table

| Tool | Best For | Strategy Style | Automation Type | Ease of Use |

| Aterna AI | Hands-off trend followers | AI-pattern, set & forget | Full native exec | Very easy |

| Tickeron | Single-coin pattern bots | ML agents (candlesticks) | Full exec via own system | Easy |

| Intellectia | Insightful swing signals | Sentiment & tech ML | Alerts/w Optionally webhook | Moderate |

| Coinrule | No-code rule automation | IF–THEN rule templates | Native exchange bots | Beginner-friendly |

| TradeIdeas | Advanced signal scanners | AI scan alerts | Alerts -> external exec | Power-user complexity |

| TradingView | Custom strategy builders | Pine Script custom | Alert webhooks via connector | Advanced setup |

| TradeSanta | Reliable template bots | Grid, DCA, futures | Native automation | Very user-friendly |

| Kavout | Signal-based analysis | Scoring signals | Alerts/manual | Insight-focused |

| Signal Stack | Alert execution bridge | Any alert logic | Webhook trade execution | Lean and reliable |

| Bitsgap | Multi-exchange crypto bots | Grid, DCA, combo | Native exchange automation | Crypto-focused usability |

Conclusion & Top 3 Recommendations

My top picks based on real testing:

1. Coinrule – For flexible, no-code automation across exchanges. Best mix of usability and performance.

2. TradeSanta – If you want dependable grid/DCA/futures bots running on autopilot. Little friction, reliable execution.

3. Signal Stack – Ideal for those with custom signal systems who just want fast, painless execution. Keeps the complexity in strategy, not plumbing.

Other tools shine too:

- Intellectia is gold if you value insight over automation

- Tickeron is handy for single-asset focus

- TradeIdeas is unmatched in scanning depth once it’s dialed in

If you’re new—start with Coinrule or TradeSanta. If you’re customizing strategies—use TradingView + Signal Stack. If you want signal-driven insight—Intellectia fits best. Choose based on how much you want code vs templates, control vs autopilot, and insight vs execution.

Leave a comment