You register for Trade Ideas expecting another charting platform—but quickly realize it’s more like a turbocharged idea engine. That AI analyst—Holly—is scanning thousands of equities, and engines like The Money Machine or TradeWave aim to serve you trade signals, execution pathways, and pattern-based trade flow. Not just charts—real-time insight.

What Is Trade Ideas, Really?

At its core, Trade Ideas is an AI‑powered stock scanning and trade signaling platform, built for active day and swing traders. It offers:

- Holly AI, a first-gen AI that analyzes overnight data, selects high‑odds setups

- OddsMaker for backtesting strategies using historical simulation

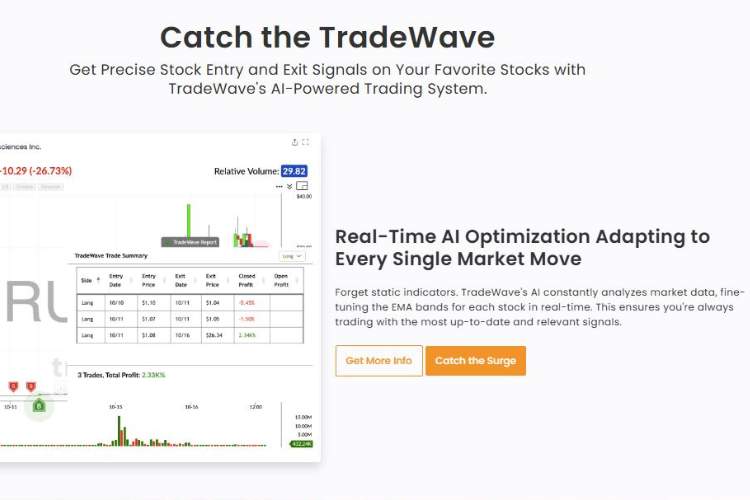

- TradeWave: momentum‑based strategy lab adapting in real‑time

- Stock Race widget: live ranking “races” of movers based on your scans

- Broker integration with Interactive Brokers and others for execution

Bottom line: it’s not a trading bot per se, but it enables automated workflow with live alerts, scripting tools, brokers, and backtesting.

My Testing Story… Out of Order

Day 1: Set up a custom scan—volume spike + price move over 2%—and tried the race feature. Saw a little ticker shoot to the top! Felt like the market whispering “here’s your setup.”

Day 2: Fired up TradeWave: watched momentum bands auto‑adjust through the session. One day trade popped and exited cleanly. Fun twist: felt robotic yet kinda alive.

Day 3: Backtested my scan in OddsMaker. Realized half the signals were overfitting summer 2024 volatility—ouch. Gotta tune filters better.

Day 4: Joined their chat room via live trading room. Volunteers narrated intraday trades—mainly low float scalps. A blast but also reminded me of FOMO traps.

Interspersed: I’d hit confusion with interface. Tutorial vids helped—but feature density is real. Support answered me within hours—friendly tone Yeah, they knew the lingo.

Feature Breakdown

| Feature | What It Does | My Take |

| Holly AI | Overnight AI strategy optimizer | Picks, but not prophets—filter still needed |

| TradeWave | Momentum‑based automation & ranking | Great for intraday momentum setups |

| Stock Race | Real-time scanning visuals | Addictive and fast, like watching market races live |

| OddsMaker | Backtesting & strategy validation | Must‑have before risking real money |

| Custom Scans & Alerts | Build filter conditions + real‑time alerts | Powerful, but needs care to avoid noise |

| Paper Trading / Broker | Connect IBKR; simulate or auto‑execute trades | Seamless, once you iron alerts syntax |

Pros & Cons (my view)

Pros:

- Real-time AI alerts & pattern signals (Holly, OddsMaker, TradeWave)

- Custom scanning tools with live updating windows

- Visually rich widgets like Stock Race add fun and clarity

- Backtesting and simulated trading built-in

- Integrates with Interactive Brokers and others for live orders

Cons / Quirks:

- Steep learning curve—feature overload can overwhelm

- Pricey—TI Basic is $89/month, TI Premium jumps to $178/mo ($2136/yr)I

- Chat room chat is high‑octane scalps, may trigger FOMO

- Mostly US stocks—less Forex/commodities support

- No true “set-and-forget” AI bot; you still manage your strategy

Emotional Highlights

First signal ping sent me a rush—like hearing the market gasp. Then came the gut-punch: signal went sideways, stop-loss triggered. Felt deflated. But I learned: Tight strategy plus OddsMaker backtesting could avoid that. That emotional arc—hope, panic, thought—felt real.

Watching TradeWave adapt intraday made trading feel less mechanical, more lively. Conversely, community FOMO in chat rooms made me question discipline. I realized Trade Ideas is empowerment—but can also tempt recklessness.

Pricing & Value Proposition

| Plan | Price/month (annual) | Includes |

| Free “Par Plan” | $0 (delayed data) | Stock races, PIP charts, basic scan |

| TI Basic (Birdie) | ~$89 ($1068) | Live data, paper trading, alerts |

| TI Premium (Eagle) | ~$178 ($2136) | Holly AI, TradeWave, backtesting, broker integration |

Full access means access to AI signals, customizable automation tools, and live broker link. For active traders who routinely scan and act, Premium may pay off. Casual users may find Basic enough.

Is This the Best AI Trading Tool?

Depends on what you expect. If you want AI to auto‑execute trades while you nap, look elsewhere. Trade Ideas demands active strategy tuning—it’s a toolset for high‑velocity, insight-driven traders.

But based on G2 ratings (4.7★), LiberatedStockTrader’s 4.7 score, and reviews from StockBrokers.com praising its AI edge, it seems one of the strongest signals platforms available.

Who Should Use It?

- Day traders who thrive on real-time alerts and momentum flows

- Swing traders with custom scan criteria and backtesting discipline

- Data-driven traders ready to build and refine strategy scans

- Users comfortable managing manual trade execution but craving AI signal intelligence

Avoid if you want hands-off automation—not meant for long-term passive investing or lightweight hobbyists.

Suggestions for Improvement

- Simplified onboarding tutorials layered by user skill level

- Mobile‑first dashboard or push alert apps improve field usability

- Broader global asset coverage (crypto / FX modules?)

- Better FOMO control features or rate-limit chat access for overwhelmed newbies

- Flexible pricing tiers for micro‑traders or seasonal use

Final Verdict

Trade Ideas feels like strapping into a trading cockpit rather than dialing in passive AI signals. It’s robust, sophisticated, and exhilarating—but demands engagement. With Holly AI, TradeWave, OddsMaker, and live broker integration, it forms a full-stack real-time insight system.

If you’re ready to handle alerts, refine scans, and act fast—the platform rewards precision. If you just want a bot to execute while you sleep, it’ll frustrate you. Start free via the Par Plan, then step into Basic or Premium once comfortable.

Want help designing a scan or configuring TradeWave logic? Happy to walk through sample setups or refine strategy parameters.

Leave a comment